cares act illinois student loans

Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act. The Coronavirus Aid Relief and Economic Security CARES Act is a 22 trillion stimulus package passed in March 2020 to address the coronavirus pandemic which was.

Illinois Mechanic S Lien Affirmation Vsd 526 14 Car Title Letter Of Employment Affirmations

Federal income taxes on the.

. This includes Direct Stafford Loans Direct PLUS Loans for. Under CARES Act The CARES Act allows for the following relief to federal student borrowers. 5 hours agoA college student at Johns Hopkins University reviews Calculus homework.

Section 18004c of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for. CARES Act Student Loan Borrower Protections. In the United States more than 44 million borrowers in the United States carry student loan debt totaling nearly 16 trillion.

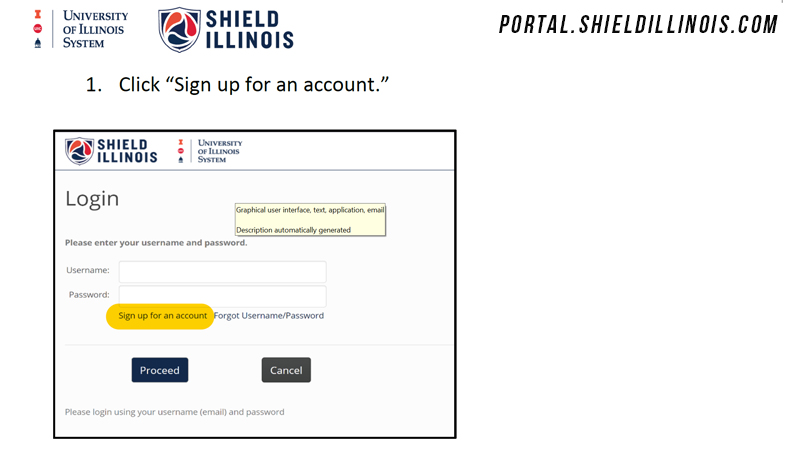

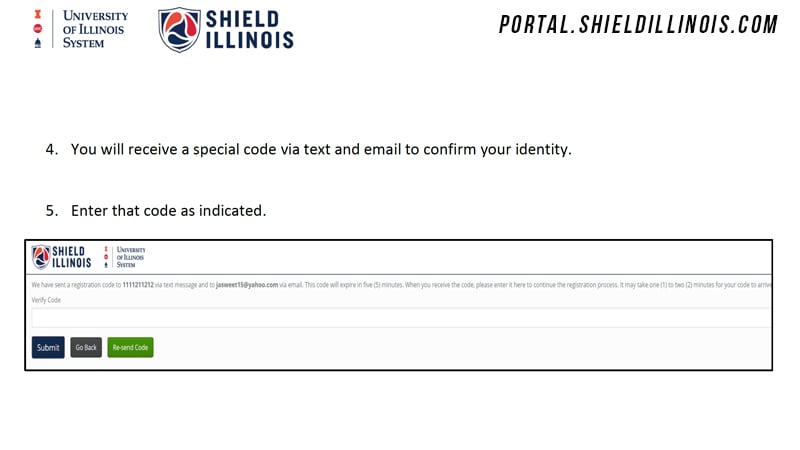

The CARES Act gives employers a number of ways to use their education assistance programs to support their people. Suspension of the accrual of interest. The CARES portal can be found at httpscaresapphfsillinoisgov.

Cares act illinois student loans Monday January 10 2022 Edit. Suspends student loan monthly payments for 6 months. While the CARES Act provided much-needed relief for those with federal student loans millions of people with private non-federal student loans were left out.

The portal is open from September 29 2020 through noon on Saturday October 31 2020. Education Stabilization Fund Transparency Portal March 17 2021 Covid-Relief-Dataedgov is dedicated to collecting and disseminating data and information. The CARES Act instructs the Department of Education to defer loan payments with no punishment to loan holders as well as convert all interest rates to 0 until September 30.

The COVID-19 emergency relief measures were extended through Aug. Federal student loans that are owned by the US. Students with federal student loans.

Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. He also tells how physicians can best take advantage of some of the new changesI. If you are currently paying federally held student loans the CARES Act may provide you some relief during the COVID-19 public health crisis including automatically suspending.

Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. Student Loan Debt. Deferral of loan payments until September 30 2020.

The CARES Act allows employers to pay up to 5250 toward student loans on behalf of employees and the employees would not owe US. Student Loan Scams 3 Warning Signs To Watch For Money Tell The Department Of Education To Fix Public. This bill allotted 22 trillion to provide fast.

Federal income taxes on the payments. The cares act provides assistance to most federal student loan borrowers and if you have this type of debt heres what the new law can do for you. With the CARES Act and Higher Education Economic Relief Fund federal COVID-19 financial aid.

A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. The new initiative applies to borrowers who were not provided relief under the federal Coronavirus Aid Relief and Economic Security Act or CARES Act which was signed by. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1.

Allocates 25 billion in federal transit formula funding to keep public transit operating. Jon describes the CARES act from March and how student loans are affected. CARES Act Emergency Relief.

This QA contains general statements of policy under the Administrative Procedure Act issued. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. They can communicate the act to ensure all.

The Student Investment Account Act 110 ILCS 991 permits the Office of the Illinois State Treasurer Treasurer to establish the Student Investment Account which will invest up to. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. Department of Education are covered under the CARES Act.

The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020.

Washington State Student Loan Forgiveness Programs Washington State Flag Washington State Washington

The Most Useful Credit Repair Tips Every College Student Needs The Baller On A Budget An Affordable Fashion Beauty Lifestyle Blog Credit Repair Paying Off Credit Cards Credit Score

Applying For Fafsa Northeastern Illinois University

This College Just Cancelled 2 1 Million Of Student Loans

The Best Designed Building In Every U S State Architectural Digest Building Capitol Building Student Loan Payment

Http Www Infographicdesignteam Com Full Length Website Screenshots By Snapito Health Insurance Plans Infographic What Is An Infographic

Aatp Offer 2022 Us Continuing Education Credits Medical Oncology Continuing Education

Illinois And Federal Financial Aid Programs

The Bankruptcy Law Firm Of David Galler Can Helps He Can Recommend The Best Bankruptcy Solution For Your Needs Debt Relief Programs Tax Debt Debt Resolution

Student Loans Interview Skills Interview Preparation Student Studying

Reminder Ilrpp Rental Assistance Applications Must Be Submitted By 11 59 P M Sun Jan 9 2022 Illinois Realtors

Illinois Student Loan Forgiveness Programs

Illinois To Use 2 7 Billion In Federal Relief Funds To Pay Off Covid Related Debt Chicago News Wttw

Cares Covid Information Rend Lake College

Cares Covid Information Rend Lake College

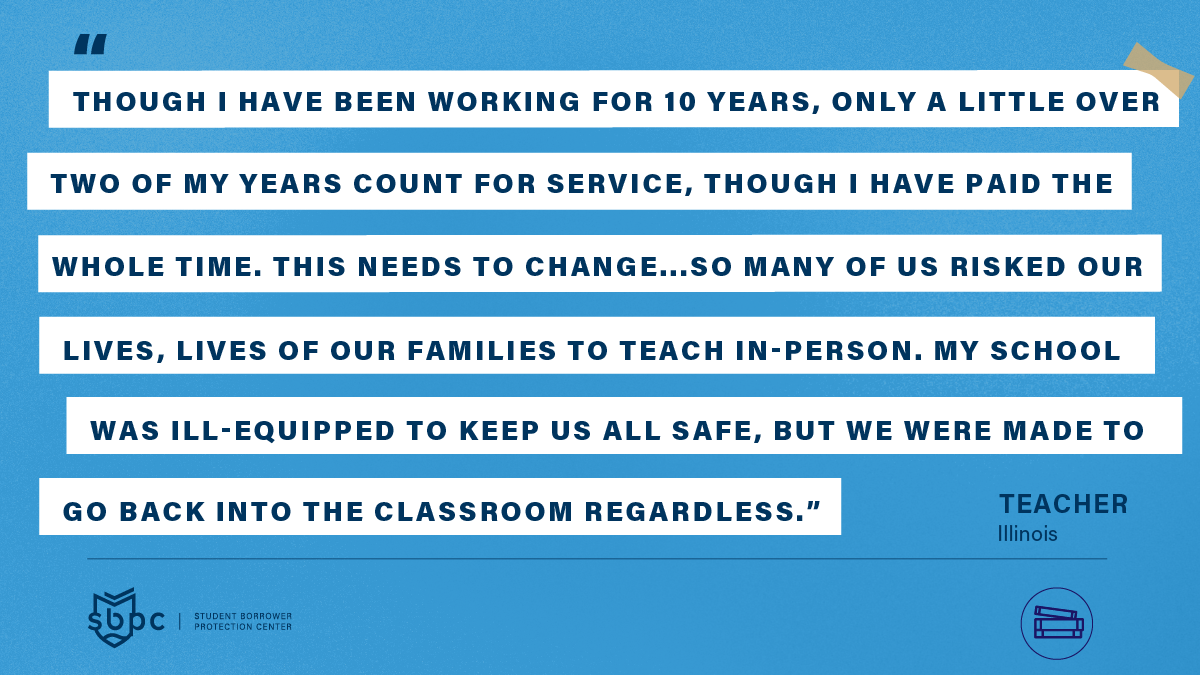

Frontline Workers Who Fought Through The Pandemic Are Being Denied Promised Student Debt Forgiveness Student Borrower Protection Center

These States Will Pay Off Your Student Loan Debt If You Buy A Home There

Aca Medicaid Expansion In Illinois Updated 2022 Guide Healthinsurance Org Medicaid Job Coaching Health Insurance Broker