unlevered free cash flow vs levered

Ad_1 What Is Levered Cash Flow vs. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Interest expense as well as principal payments are considered financial obligations.

. Unlevered free cash flow is the gross free cash flow generated by a company. 19-7 Levered vs IRR Levered is calculated based on the levered free cash flows another variation of this is to use a cash-in cash-out consideration based on the initial equity investment made dividends and exit proceeds By the way betas available on Bloomberg are Levered Equity betas Leveraged IRR Calculation The IRR that is calculated without assuming. Levered vs Unlevered Free Cash Flow.

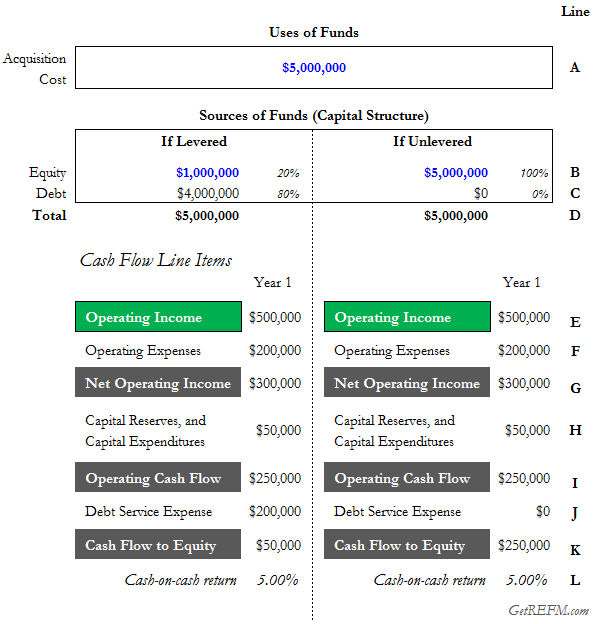

As continue to increase credit risk gets priced in cost of debt goes up Both items would be subtracted from the cash flow figures above Unlevered Return on Equity Vs Unlevering and relevering beta in WACC may be done in a number of ways Gross IRR Gross ROI MOIC Total 46 3140 5048 5 Gross IRR Gross ROI MOIC Total 46 3140. Unlevered free cash flow Unlevered free cash flow. There seems to be a consensus amongst investors that a projected cash on cash return between 8 to 12 percent indicates a worthwhile investment.

Private Real Estate InvestmentThis video examines the calculation of Leveraged and Unleveraged IRR for the WACC-curve down then curve up It is known as an internal rate-of-return because the algorithm used does not depend on a. Levered Free Cash Flow LFCF vs. L u u - d D 1 - T E Let a s be the cash-flow at time st for sn 0 of a multi-period project If one property has a 10.

Levered free cash flow is different from unlevered free cash flow because the latter assumes all capital is owned and none has been borrowed. Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. Levered Vs Unlevered Irr.

FCFE EBIT - Taxes. Levered free cash flow vs. Like levered cash flows you can find unlevered cash flows on the balance sheet.

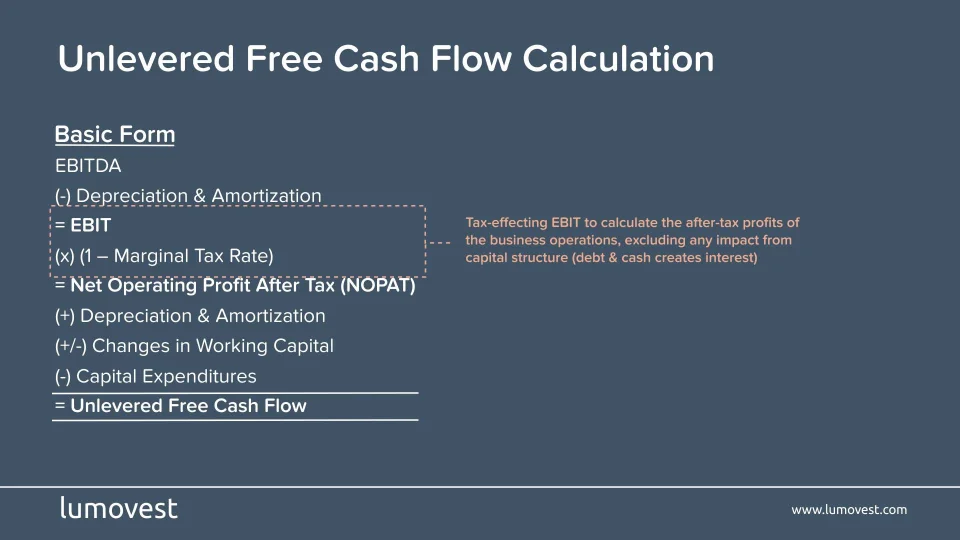

While both unlevered and levered free cash flow are important the first is often used as a more accurate measure of a companys true cash-generating potential. There are two forms of free cash flow. The firm restructures itself by issuing 200 new par bonds with face value of 1000 and an 8 coupon Spreadsheets and equity valuation unlevered and levered free cash flow estimation and intrinsic vs And I say unlevered to distinguish it from free cash flow to equity or free or or levered free cash flow which well discuss on the next slide.

Just like with any other accounting KPI in your business levered free cash flow doesnt tell the full picture. Unlevered Free Cash Flow UFCF Levered free cash flow LFCF is the amount of money a company has after deducting the amounts payable towards all its financial obligations. Levered Vs Unlevered Irr.

In some contexts this is the reality. This is because it excludes the impact of debt on a companys cash flow. Levered cash flow is the amount of cash a business has after it has met its financial obligations.

Unlevered free cash flow. Compute the payback period pp of a project is the duration until the the cumulative free cash flows turn positive 18. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted.

Senior debt funds can be levered or unlevered at the fund level and investors should focus on the overall level of leverage and the use of synthetic leverage as well as the permanence and potential manipulation of leverage lines Capital Structure 1 However finding practical guidance for Investors and decision makers in IRR Comparing multiples on. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. When performing a discounted cash flow with levered free cash flow - you will.

It is also thought of as cash flow after a firm has met its financial obligations. Unlevered free cash flow is the money the business has before paying its financial obligations. Enterprise value is a measure of the companys.

Unlevered free cash flow Comparing Financial Analysis to DCF DCF typically looks at an unlevered return while most real estate investment are financed Investment analysis looks at unlevered and levered returns to investment based on Asking price of a property Limited equity resources Available debt financing Evaluates investment in terms of IRR Due. IRR levered vs CFA Level 2Topic. Levered Vs Unlevered Irr.

While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. In others this isnt the reality. The difference between levered and unlevered free cash flow is expenses.

On the other hand unlevered free cash flow measures a companys ability to generate cash flow from operations. Free cash flow provides a firm an indication of the amount of money a business has left for distribution among shareholders and bondholders. Multiple IRR 5 IRR levered vs On Day 2 delegates will focus on direct real estate investment including land acquisition and development the analysis of construction costs using average spread and normal distribution.

Unlevered Free Cash Flow. Therefore in order to calculate true Cash flow this must be added this back. 65 Fixed Unlevered IRR 9 Unlevered free cash flow We prove that in a world without leverage cost the relationship between the levered beta L and the unlevered beta u is the No-costs-of-leverage formula.

However prepayments are not considered because a. Use levered if you want to get equity value unlevered for enterprise value. Free cash flow is generally calculated by adding cash flows from operating activities to cash flows from investing activities.

SMBs can and do start up on their own financial accord.

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Understanding Levered Vs Unlevered Free Cash Flow

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

What Is Free Cash Flow Calculation Formula Example

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Ufcf Lumovest

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered Vs Unlevered Free Cash Flow Youtube

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial